-

Casella Waste Systems, Inc. to Acquire Select Solid Waste Operations From GFL Environmental Inc. That Will Expand Footprint Into Adjacent Markets and Provide a Platform for Future Growth

المصدر: Nasdaq GlobeNewswire / 24 أبريل 2023 06:30:00 America/Chicago

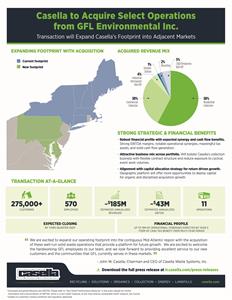

RUTLAND, Vt., April 24, 2023 (GLOBE NEWSWIRE) -- Casella Waste Systems, Inc. (Nasdaq: CWST), a regional solid waste, recycling, and resource management services company, announced the signing of an equity purchase agreement on April 21, 2023, to acquire collection, transfer, and recycling operations in Pennsylvania, Delaware, and Maryland from GFL Environmental Inc. (“GFL”) for a purchase price of $525 million. The proposed acquisition includes nine hauling operations, one transfer station, and one material recovery facility with aggregate annualized revenues of approximately $185 million. The acquisition is expected to close by the third quarter of 2023, subject to customary closing conditions, including regulatory approvals.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/dfbe7bda-d62f-4692-a375-9215c5184f68

“Today’s announcement marks an important step forward in the company’s growth strategy by using the strength of our balance sheet and proven capital discipline to make a compelling investment,” said John W. Casella, Chairman and CEO of Casella Waste Systems, Inc. “After successfully extending our footprint into the adjacent Connecticut market with an acquisition in mid-2021, this acquisition will enable us to expand into the Mid-Atlantic region with these well-run solid waste operations that provide a platform for future growth.”

“We have worked with the GFL team to conduct extensive due diligence and to start a collaborative integration and transition planning process,” Casella said. “Over the last five years we have built a strong team focused on successfully integrating and driving returns from acquisitions. In addition, our existing team includes several talented professionals who have experience with these specific operations and markets, which provides us even more confidence around a successful integration process to drive further shareholder returns.”

“We look forward to welcoming the hardworking GFL employees to our team,” Casella said. “And, we look forward to the opportunity to provide excellent service to our new customers and the communities that GFL currently serves in these markets.”

Strong Strategic and Financial Benefits

- Expands footprint into contiguous markets for additional growth opportunities. The pending acquisition of solid waste assets in the Pennsylvania, Maryland and Delaware markets is a natural extension to Casella’s existing footprint in the Northeast and offers future organic and inorganic growth opportunities. Casella’s resource management approach to providing value to its customers through sustainable solutions represents great potential to grow its commercial and industrial segments.

- Robust financial profile with synergy and cash flow benefits. The operations and transaction structure are expected to provide solid financial benefits that will help to drive continued strong cash flow growth. Casella expects the acquired operations to generate approximately $185 million of revenues and $43 million of EBITDA1 during the first 12-months. In addition, Casella expects to generate approximately $8 million of incremental annual synergies and benefits by year three of operations through internalizing certain volumes into its disposal network and capturing fleet automation efficiencies. Further, given the structure of the transaction, it is expected that the acquisition will create significant cash tax benefits to Casella, estimated to be greater than $130 million of savings over a multi-year period.

- Attractive business mix across the portfolio. Approximately 80% of the revenues to be acquired are currently generated in the open market from commercial collection and subscription residential collection customers. Further, approximately 5% of the revenues to be acquired are currently generated from construction and development activity which is expected to further reduce exposure to more cyclical and event-driven lines of business on a consolidated pro forma basis.

- Alignment with capital allocation strategy for return driven growth. The transaction is consistent with Casella’s 2024 strategic plan of opportunistically deploying capital at strong, risk-adjusted return levels to create long term shareholder value.

Financing of the Acquisition

The acquisition is not subject to any financing conditions and Casella expects to fund the purchase price through a combination of cash on hand, revolving credit facility borrowings, and from a planned new Term Loan A under its existing senior secured credit facility. Casella received a bridge financing commitment from Bank of America, N.A., BofA Securities Inc., JPMorgan Chase Bank N.A., Comerica Bank, and Citizens Bank, N.A. Following completion of the acquisition, Casella expects to maintain a strong credit profile and balance sheet, with its consolidated net leverage ratio expected to increase to approximately 3.59 times2 pro forma based on December 31, 2022, historical financials for Casella. Casella remains committed to reducing its consolidated net leverage ratio to below its target of 3.25 times as per its 2024 Strategic Plan as announced in February 2022.

Approvals and Closing Timeline

The acquisition was unanimously approved by Casella’s Board of Directors and is expected to close by the third quarter of 2023, subject to customary closing conditions, including regulatory approvals.

Casella Confirms Previously Announced First Quarter 2023 Earnings Call

Casella Waste Systems, Inc. will release first quarter 2023 results after the market close on April 27, 2023, and host a conference call to discuss these results the following morning on April 28, 2023, at 10:00 a.m. Eastern Time. At that time, management will be available to discuss the pending acquisition and its overall growth strategy.

About Casella Waste Systems, Inc.

Casella Waste Systems, Inc., headquartered in Rutland, Vermont, provides resource management expertise and services to residential, commercial, municipal, institutional and industrial customers, primarily in the areas of solid waste collection and disposal, transfer, recycling and organics services in the northeastern United States. For further information, contact Jason Mead, Senior Vice President of Finance and Treasurer at (802) 772-2293; or visit the Company’s website at http://www.casella.com.

Safe Harbor Statement

Certain matters discussed in this press release, including but not limited to, the statements regarding our intentions, beliefs or current expectations concerning, among other things, projections as to the anticipated benefits of the proposed transaction; the anticipated impact of the proposed transaction on the Company’s business and future financial and operating results; the expected amount and timing of synergies from the proposed transaction; and the anticipated closing date for the proposed transaction are "forward-looking statements". These forward-looking statements can generally be identified as such by the context of the statements, including words such as “believe,” “expect,” “anticipate,” “plan,” “may,” “would,” “intend,” “estimate,” “will,” “guidance” and other similar expressions, whether in the negative or affirmative. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which the Company operates and management’s beliefs and assumptions. The Company cannot guarantee that it actually will achieve the financial results, plans, intentions, expectations or guidance disclosed in the forward-looking statements made. Such forward-looking statements, and all phases of the Company’s operations, involve a number of risks and uncertainties, any one or more of which could cause actual results to differ materially from those described in its forward-looking statements.

Such risks and uncertainties include or relate to, among other things, the following: failure to satisfy all closing conditions, including receipt of regulatory approvals, that may prevent closing of the transaction; the Company may not fully recognize the expected financial benefits from the acquisition due to an inability to recognize operational cost savings, market factors, landfill internalization benefits, or due to competitive or economic factors outside its control which may impact revenue and costs, or for other reasons; and the Company may be unable to achieve its acquisition goals as part of the 2024 strategic plan due to competition for attractive targets or an inability to reach agreement with potential targets on pricing or other terms.

There are a number of other important risks and uncertainties that could cause the Company’s actual results to differ materially from those indicated by such forward-looking statements. These additional risks and uncertainties include, without limitation, those detailed in Item 1A. “Risk Factors” in the Company’s most recently filed Form 10-K for the fiscal year ended December 31, 2022, and in other filings that the Company may make with the Securities and Exchange Commission in the future.

The Company undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Performance Measures

In addition to disclosing financial results prepared in accordance with generally accepted accounting principles in the United States ("GAAP"), the Company also presents non-GAAP performance measures such as EBITDA and EBITDA as a percentage of revenues that provide an understanding of operational performance because it considers them important supplemental measures of the Company's performance that are frequently used by securities analysts, investors and other interested parties in the evaluation of the Company's results. The Company also believes that identifying the impact of certain items as adjustments provides more transparency and comparability across periods. Management uses these non-GAAP performance measures to further understand its “core operating performance” and believes its “core operating performance” is helpful in understanding its ongoing performance in the ordinary course of operations. The Company believes that providing such non-GAAP performance measures to investors, in addition to corresponding income statement measures, affords investors the benefit of viewing the Company’s performance using the same financial metrics that the management team uses in making many key decisions and understanding how the core business and its results of operations has performed.

Non-GAAP Reconciliation of Acquired estimated EBITDA to Acquired estimated Net Income1 $ in millions Year 1

AnnualizedNet income $ 14 Net income as a percentage of revenues 7.6 % Provision for income taxes - Interest expense, net - Depreciation and amortization 29 EBITDA $ 43 1 Estimated based upon pro forma initial 12-month period. Non-GAAP Liquidity Measures

We present non-GAAP liquidity measures such as Consolidated EBITDA, Consolidated Funded Debt, Net and Consolidated Net Leverage Ratio that provide an understanding of the Company’s liquidity because we consider them important supplemental measures of our liquidity that are frequently used by securities analysts, investors and other interested parties in the evaluation of our cash flow generation from our core operations that are then available to be deployed for strategic acquisitions, growth, investments, development projects, unusual landfill closures, site improvements and remediation, and strengthening our balance sheet through paying down debt. We also believe that identifying the impact of certain items as adjustments provides more transparency and comparability across periods. Management uses non-GAAP liquidity measures to further understand our cash flow provided by operating activities after certain expenditures along with our consolidated net leverage and believes that these measures demonstrate our ability to execute on our strategic initiatives. We believe that providing such non-GAAP liquidity measures to investors, in addition to corresponding cash flow statement measures, affords investors the benefit of viewing our liquidity using the same financial metrics that the management team uses in making many key decisions and understanding how the core business and cash flow generation has performed.

Debt and Credit Metrics1 $ in millions Actual 12 months

ended Dec. 31,

2022Acquisition & Related

FinancingPro forma 12

months ended

Dec. 31, 2022Reconciliation of Consolidated EBITDA (as defined by the Company's Amended and Restated Credit Agreement2) to Net Cash Provided by Operating Activities: Net Cash Provided by Operating Activities $ 217 $ 43 $ 260 Changes in assets and liabilities, net of effects of acquisitions and divestitures 11 - 11 Stock based compensation and related severance expense, net of excess tax benefit (8 ) - (8 ) Operating lease right-of-use assets expense (5 ) - (5 ) Disposition of assets, other items and charges, net (1 ) - (1 ) Interest expense, less amortization of debt issuance costs and discount on long-term debt 22 - 22 Provision for income taxes, net of deferred taxes 5 - 5 Adjustments as allowed by the applicable credit facility agreement 15 - 15 Consolidated EBITDA $ 257 $ 43 $ 300 Debt and Leverage Metrics: Consolidated Funded Debt, net $ 534 $ 544 $ 1,078 Consolidated Net Leverage Ratio (Consolidated Funded Debt, net divided by Consolidated EBITDA) 2.08x 3.59x 1 Estimated based upon pro forma capitalization, including estimated fees and transaction costs. 2 As calculated per the anticipated April 2023 amended and restated credit agreement. _________________________________

1 Please refer to “Non-GAAP Performance Measures” below for further information and a reconciliation of EBITDA, which is a non-GAAP measure, to the most directly comparable GAAP measure, net income.

2 Please refer to “Non-GAAP Liquidity Measures” below for further information about consolidated funded debt, net and consolidated EBITDA (as defined by the Company’s Amended and Restated Credit Agreement) and a reconciliation of consolidated EBITDA, to the most directly comparable GAAP measure, net cash provided by operating activities. Consolidated net leverage ratio (the “Net Leverage Ratio”) is calculated as consolidated funded debt, net of unencumbered cash and cash equivalents in excess of $2.0 million and up to $100.0 million, divided by consolidated EBITDA for the applicable period. Consolidated EBITDA is based on operating results for the twelve months preceding the measurement date of December 31, 2022. On a historical basis, as of December 31, 2022, the Net Leverage Ratio is 2.08:1.00, calculated at $534.3 million, or $603.5 million of consolidated funded debt less $69.2 million of cash and cash equivalents in excess of $2.0 million, divided by consolidated EBITDA of $257.1 million. On a pro forma basis as of December 31, 2022, after giving effect to the pending acquisition of select solid waste operations from GFL Environmental Inc. and related indebtedness, the Net Leverage Ratio is 3.59:1.00, calculated at $1,078.3 million, or $1,127.5 million of consolidated funded debt less $49.2 million of cash and cash equivalents in excess of $2.0 million, divided by consolidated EBITDA of $300.1 million. Pro forma consolidated EBITDA is based on operating results for the twelve months preceding the measurement date of December 31, 2022, pro forma for the pending acquisition of select solid waste operations from GFL Environmental Inc.